Sovereign Wealth Funds: Fostering Disruption Through Long-term Capital Investments.In the ever-evolving landscape of technology and innovation, it’s no secret that advanced technologies like AI, renewable energy, and biotech are set to shape the next decade of the global economy. What’s less known, however, is the crucial role of patient capital in nurturing these game-changing ideas through their journey to success.

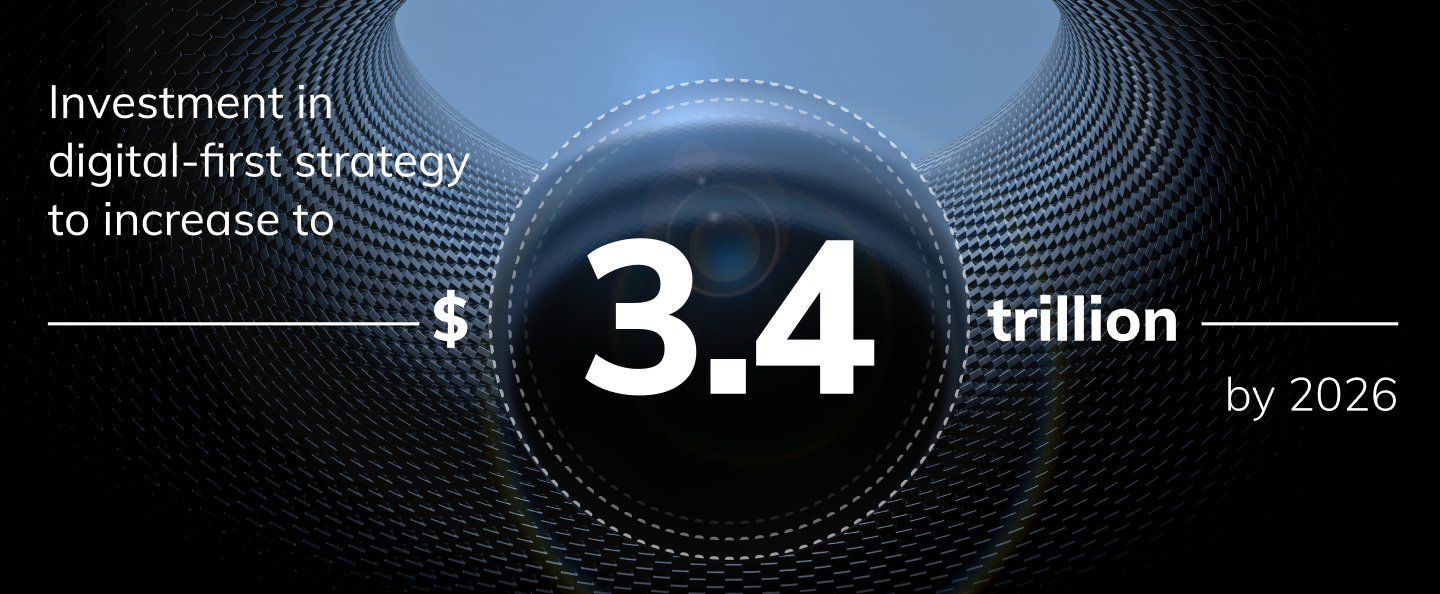

Picture this: In 2022, companies worldwide invested a staggering $1.8 trillion in integrating digital technologies into their operations. This was a 17% increase from the previous year, according to the International Data Corporation. The driving force behind this digital transformation? Sovereign wealth funds, such as Qatar’s own Qatar Investment Authority (QIA). And the investment momentum isn’t slowing down. Experts predict that by 2026, these investments will reach a whopping $3.4 trillion.

But what’s patient capital, you might ask? Well, it’s the kind of investment that’s not in a hurry to see immediate profits. It’s a long-term commitment to nurturing innovative ideas until they bloom into something extraordinary. While venture capital (VC) funds are essential for getting new ideas off the ground, patient capital steps in when the road to success is a marathon rather than a sprint.

The beauty of patient capital lies in its ability to see beyond the need for quick financial returns. It recognizes that groundbreaking innovations often take time to reach their full potential. It’s like a supportive partner in your entrepreneurial journey, understanding that the path to success is filled with twists, turns, and unforeseen challenges.Sovereign Wealth Funds: Fostering Disruption Through Long-term Capital Investments.

Patient capital becomes especially vital as companies transition from their early stages to scaling up their operations. They need reliable, long-term partners who believe in their vision and are willing to stand by their side as they navigate the complex world of business.

Recent economic shifts have underscored the importance of patient capital. After a period of rapid growth in tech stocks due to the global pandemic of 2020-2021, technology valuations have faced significant downturns since early 2022. For instance, the US health tech sector saw venture capital funding drop from $39.3 billion to $27.5 billion in 2022, according to Deloitte. Similarly, climate tech ventures experienced a funding slump, hitting their lowest levels in nearly three years.

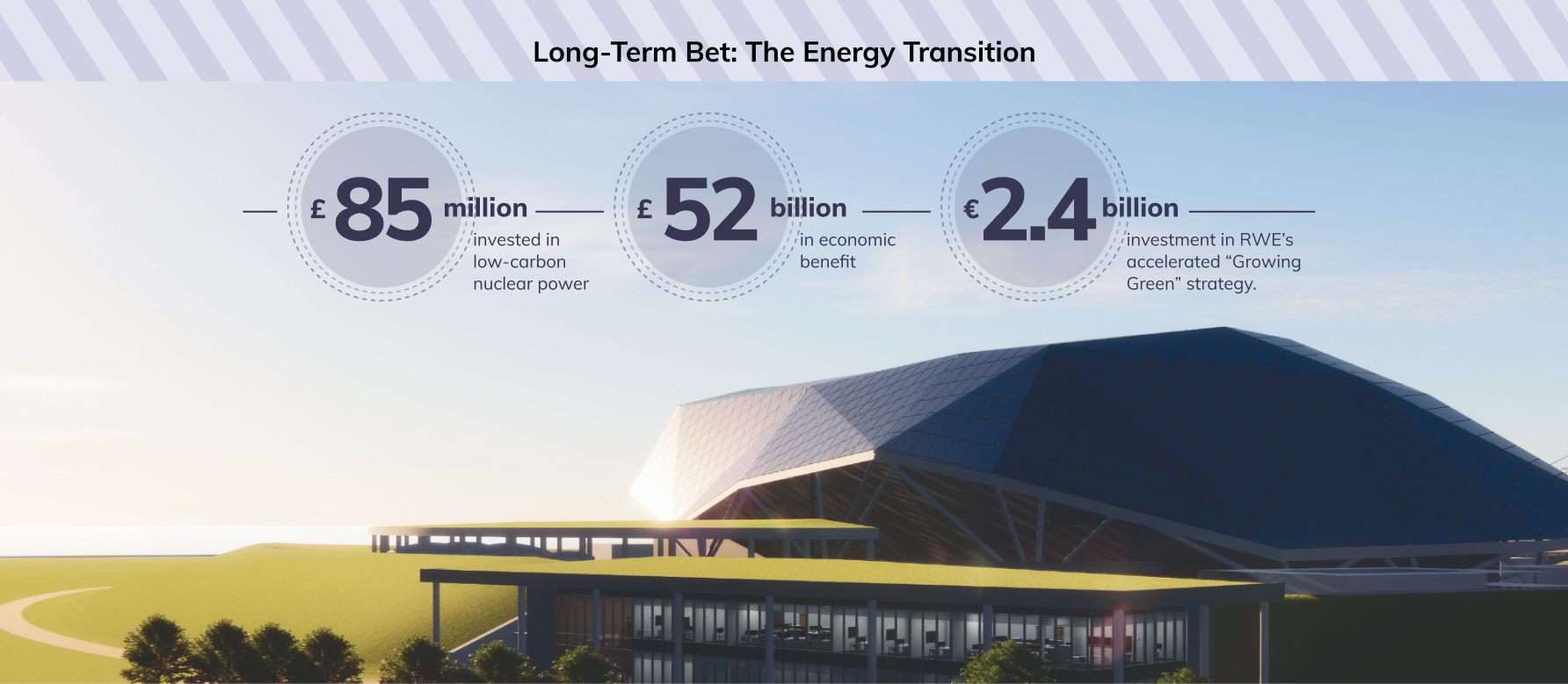

This is where sovereign wealth funds like QIA come into play. Established in 2005 to invest Qatar’s surplus revenue from liquefied natural gas, QIA now ranks as one of the world’s largest wealth funds. As the global focus on energy security intensifies, QIA is allocating more capital to promising innovations that are driving the energy transition.

In recent years, QIA has diversified its investment strategy, making substantial commitments to rapidly advancing technologies across various sectors. They see themselves as catalysts for innovation, supporting businesses that are reshaping industries such as finance, healthcare, agriculture, and business solutions.

In healthcare technology, QIA is investing in companies like Ensoma, pioneers in genomic medicine, BioXcel, which leverages AI for neuroscience and immuno-oncology advancements, and JenaValve, creators of a revolutionary heart valve system.

Food security, supply chain challenges, and a global food crisis have prompted investments in agritech technologies and startups. QIA understands that these innovations are pivotal in addressing global challenges, from food security and financial inclusion to climate change, healthcare accessibility, and energy availability.

QIA is constantly looking ahead, identifying future trends, and focusing on the champions of tomorrow, rather than short-term returns. Their geographical diversification means they’re expanding their investments in the US and across Asia, fostering partnerships with innovative companies and startups.

Despite their global reach, QIA remains committed to Europe, supporting tech unicorns like Checkout.com, an online payment platform that’s become one of Europe’s leading tech giants. In 2022, QIA participated in a $1 billion funding round for Checkout.com, underlining their dedication to transformative technologies.

In essence, Qatar’s Sovereign Wealth Fund is a beacon of patient capital, unafraid to take calculated risks, and dedicated to fostering innovation that will shape the future. It’s a reminder that sometimes, success requires the steadfast belief of long-term partners who see the bigger picture in a rapidly changing world.